The IIRC[1] recently published a new framework for reporting company performance and prospects to the financial community. The framework encourages companies to disclose information related to their ability to create value, now and in the future, rather than limiting reporting to the traditional backward-looking financial information found in company annual reports.

Unlike the Global Reporting Initiative’s G4 Sustainability Reporting Guidelines, which address reporting of material aspects to a wide range of stakeholders, including customers, suppliers, employees, local communities, regulatory agencies, industry associations, NGOs and investors, the new ![]() Framework focuses primarily on the latter audience: providers of financial capital.

Framework focuses primarily on the latter audience: providers of financial capital. ![]() is about improving the relevance of the annual report and enabling a more efficient and productive allocation of capital. Rather than replacing sustainability reporting,

is about improving the relevance of the annual report and enabling a more efficient and productive allocation of capital. Rather than replacing sustainability reporting, ![]() elevates material sustainability issues that have a bearing on value creation or erosion into mainstream investment decision-making.

elevates material sustainability issues that have a bearing on value creation or erosion into mainstream investment decision-making.

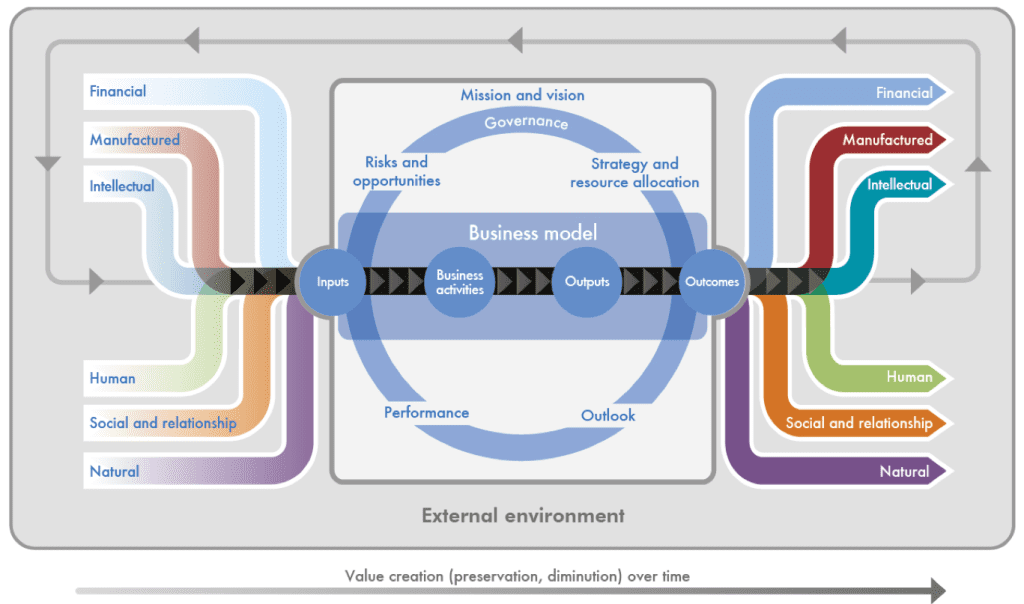

The framework encourages the company to answer a series of questions addressing its organizational overview and external environment, governance, business model, risks and opportunities, strategy and resource allocation, performance and outlook.

In describing the business model, the company should discuss its inputs, business activities, outputs, and outcomes. The inputs and outcomes are not limited to financial flows, but should also include flows of other forms of capital. Depending on the company and its sector, its effects on manufactured capital, intellectual capital, human capital, social and relationship capital, and natural capital may have a material influence on its ability to create long term value. While all these aspects should be considered, the business may, of course, use its own terminology or classification system.

Consideration of all these flows is what the IIRC refers to as integrated thinking, which the IIRC believes will lead to better decision-making both internally to the business and by the financial community. The report should analyze how the business activities have used, or been affected by, those capitals in its creation of value.

In preparing the report, the company should adhere to the framework’s guiding principles:

Strategic focus and future orientation

An ![]() report should provide insight into the organization’s strategy, and how that relates to its ability to create value in the short, medium and long term and to its use of and effects on the capitals.

report should provide insight into the organization’s strategy, and how that relates to its ability to create value in the short, medium and long term and to its use of and effects on the capitals.

Connectivity of information

An ![]() report should show a holistic picture of the combination, interrelatedness and dependencies between the factors that affect the organization’s ability to create value over time.

report should show a holistic picture of the combination, interrelatedness and dependencies between the factors that affect the organization’s ability to create value over time.

Stakeholder relationships

An ![]() report should provide insight into the nature and quality of the organization’s relationships with its key stakeholders, including how and to what extent the organization understands, takes into account and responds to their legitimate needs and interests.

report should provide insight into the nature and quality of the organization’s relationships with its key stakeholders, including how and to what extent the organization understands, takes into account and responds to their legitimate needs and interests.

Materiality

An ![]() report should disclose information about matters that substantively affect the organization’s ability to create value over the short, medium and long term.

report should disclose information about matters that substantively affect the organization’s ability to create value over the short, medium and long term.

Conciseness

Reliability and completeness

An ![]() report should include all material matters, both positive and negative, in a balanced way and without material error.

report should include all material matters, both positive and negative, in a balanced way and without material error.

Consistent with its intent, there is also a requirement for a report claiming to use the

Consistent with its intent, there is also a requirement for a report claiming to use the ![]() Framework to include a statement from those charged with governance that acknowledges their responsibility in ensuring the integrity of the report and that they have applied their collective mind to the preparation and presentation of the report, as well as their opinion or conclusion about whether the report is presented in accordance with the

Framework to include a statement from those charged with governance that acknowledges their responsibility in ensuring the integrity of the report and that they have applied their collective mind to the preparation and presentation of the report, as well as their opinion or conclusion about whether the report is presented in accordance with the ![]() Framework.

Framework.

The framework was published in early December 2013 after consultation on a draft involving both business and investor networks as well as other stakeholder groups. EEM looks forward to seeing how businesses involved in the pilot programme start using this challenging framework and how investor decisions are influenced by the more holistic performance and outlook information.

To see the concepts of in practice, readers can visit the IIRC’s Database of Emerging Practice.

Reference: The International Framework Copyright © December 2013 by the International Integrated Reporting Council (‘the IIRC’). All rights reserved. Used with permission of the IIRC. Contact the IIRC (info@theiirc.org) for permission to reproduce, store, transmit or make other uses of this document.

[1] The International Integrated Reporting Council (IIRC) is a global coalition of regulators, investors, companies, standard setters, the accounting profession and NGOs.